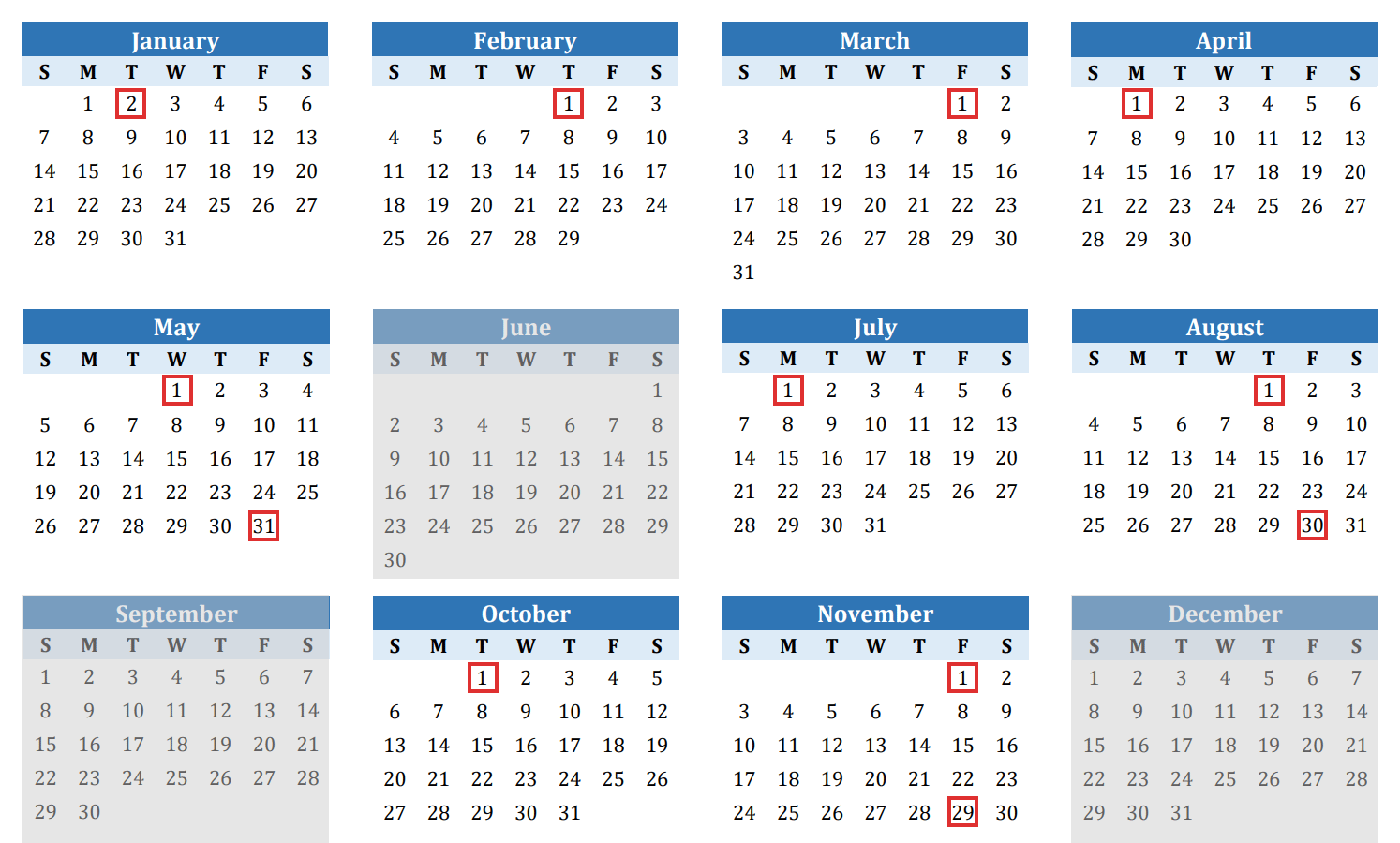

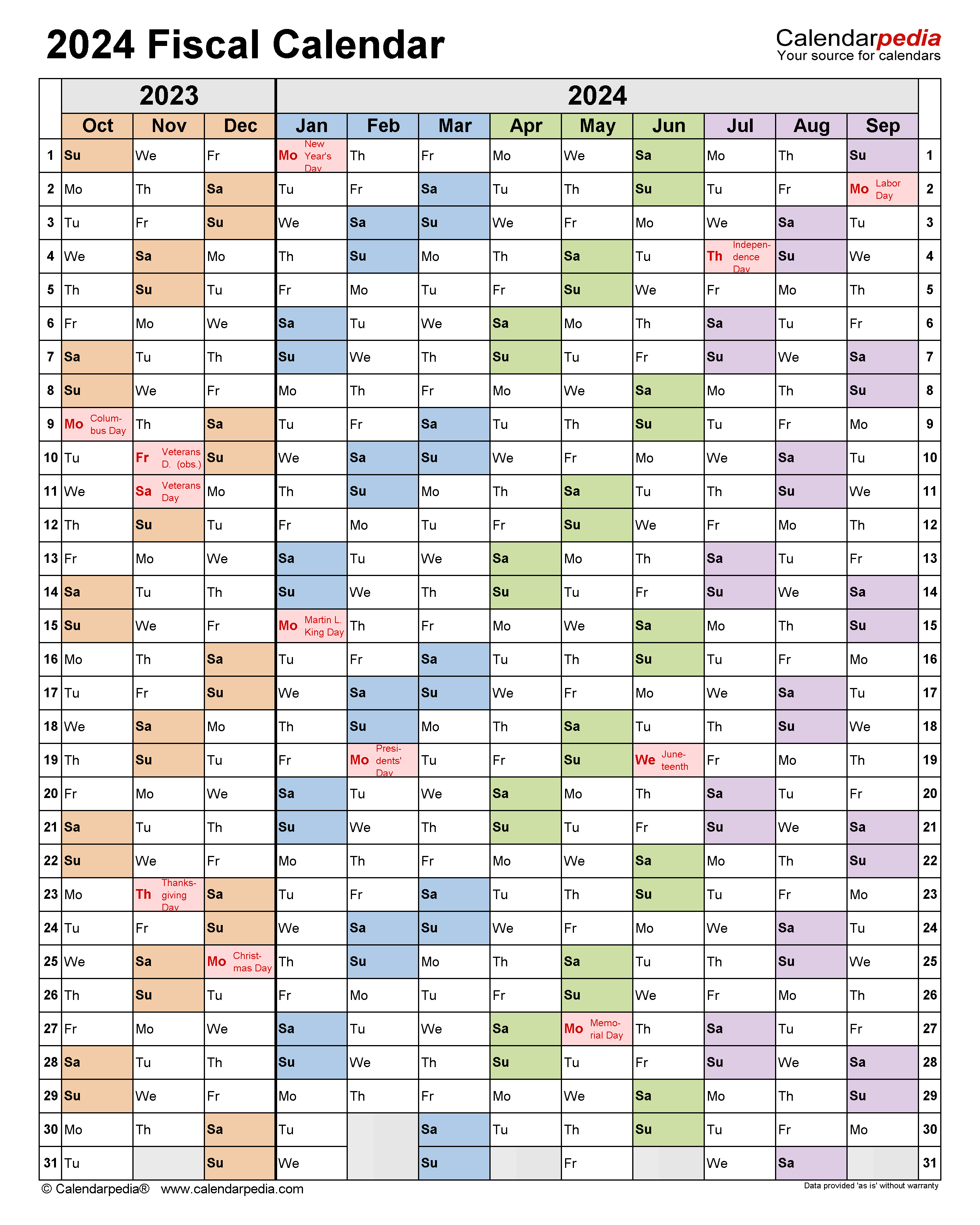

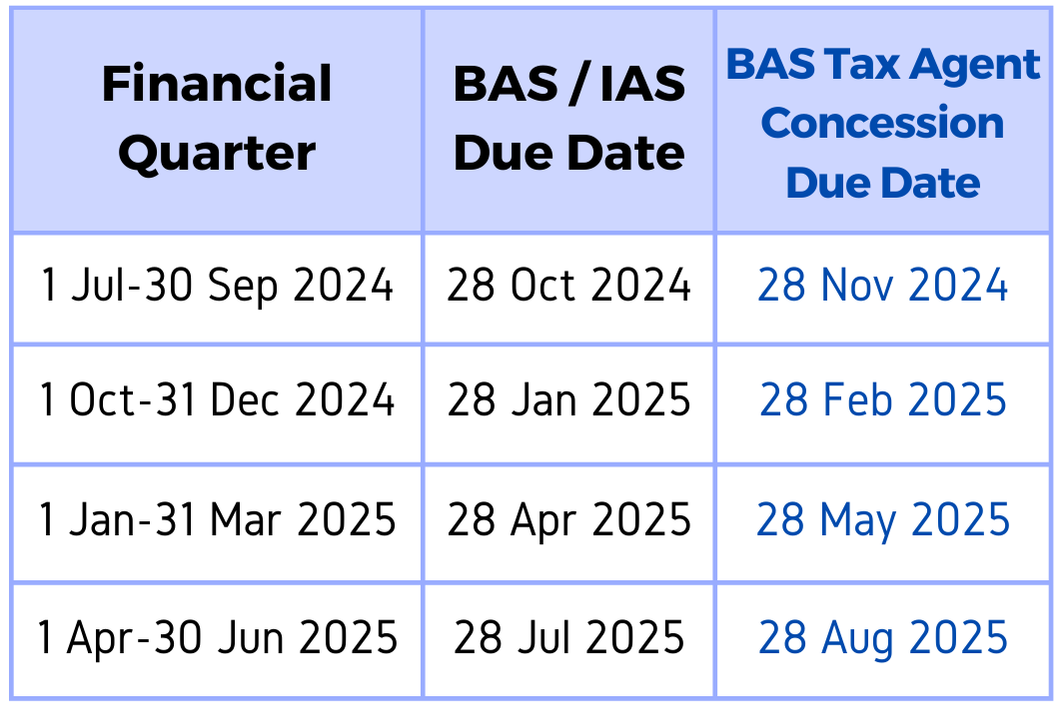

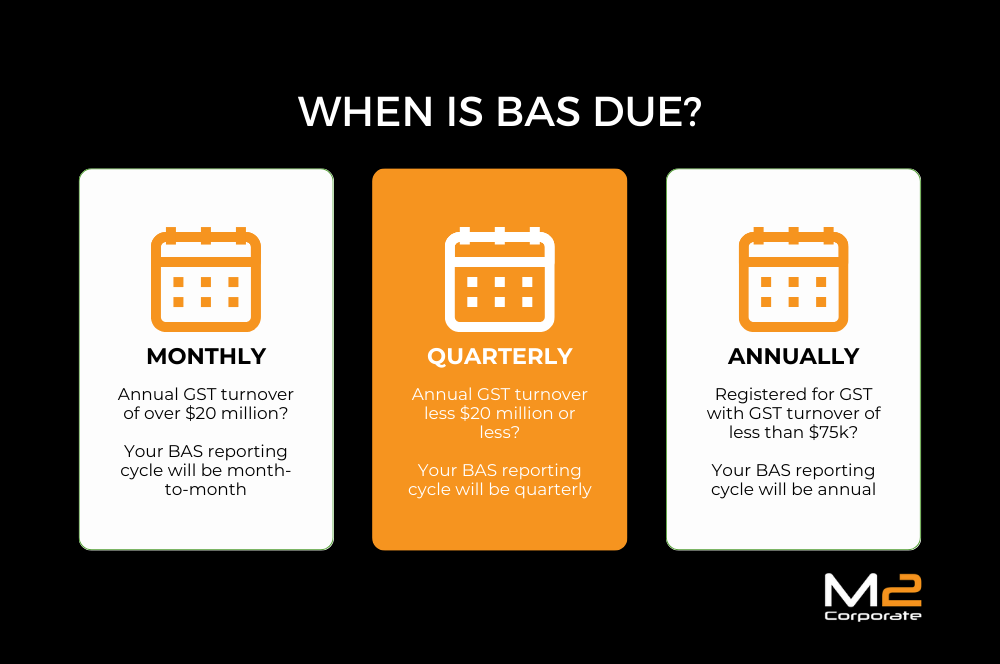

Bas Due Dates 2024. 28th day after each quarter, with an exception for q2 (28 february 2024). But late lodgement is one of the 4 common mistakes small business makes with the ato, so bookmark this page it’s got your bas due dates for quarterly and monthly reporting.

So, we’ve created this resource that not only. How to lodge your business activity statements (bas) to report and pay your taxes, including gst and payg.

Bas Due Dates 2024 Images References :

Source: www.officeworks.com.au

Source: www.officeworks.com.au

Make BAS Preparation Easier with These TimeSaving Tips Work, One of the key things we’re always asked by clients is:

Source: jonieqbeverlie.pages.dev

Source: jonieqbeverlie.pages.dev

Monthly Bas Due Dates 2024 Opm Naomi Virgina, July to september 2023 quarter is due on the 28th of october 2023.

Source: kellybmalena.pages.dev

Source: kellybmalena.pages.dev

Bas 2024 Due Dates In Hindi Breena Terrie, What is the significance of quarterly business activity statement (bas) due dates in 2024?

Source: jonieqbeverlie.pages.dev

Source: jonieqbeverlie.pages.dev

Monthly Bas Due Dates 2024 Opm Naomi Virgina, The final date for lodgment and payment for:

Source: janeqnatalya.pages.dev

Source: janeqnatalya.pages.dev

2024 Es 2024 Due Dates Nyc Kari Sandye, Get insights on penalties, extensions,.

Source: alvinayetheline.pages.dev

Source: alvinayetheline.pages.dev

Bas Payment Dates 2024 Maharashtra Cris Michal, July to september 2023 quarter is due on the 28th of october 2023.

Source: thiaymichaelina.pages.dev

Source: thiaymichaelina.pages.dev

Bas 2024 Due Dates Fawne Jenifer, Learn the key tax due dates for business activity statement (bas), payg, and tax return deadlines with.

Source: alvinayetheline.pages.dev

Source: alvinayetheline.pages.dev

Bas Payment Dates 2024 Maharashtra Cris Michal, Get insights on penalties, extensions,.

Source: babbfelicity.pages.dev

Source: babbfelicity.pages.dev

Bas Payment Dates 2024 Dolley Leeann, The final date for lodgment and payment for:

Source: ilsabmodesty.pages.dev

Source: ilsabmodesty.pages.dev

2025 Tax Calendar Due Dates Irs Emlyn Emmeline, But late lodgement is one of the 4 common mistakes small business makes with the ato, so bookmark this page it’s got your bas due dates for quarterly and monthly reporting.

Posted in 2024